WHY THE NEED?

In a nutshell, the state doesn’t provide enough funding to offer Belmont-Redwood Shores students with a well-rounded education. We live in an area with a highly educated work-force and fierce competition for quality jobs, yet our schools are funded at nearly the lowest level in the nation.

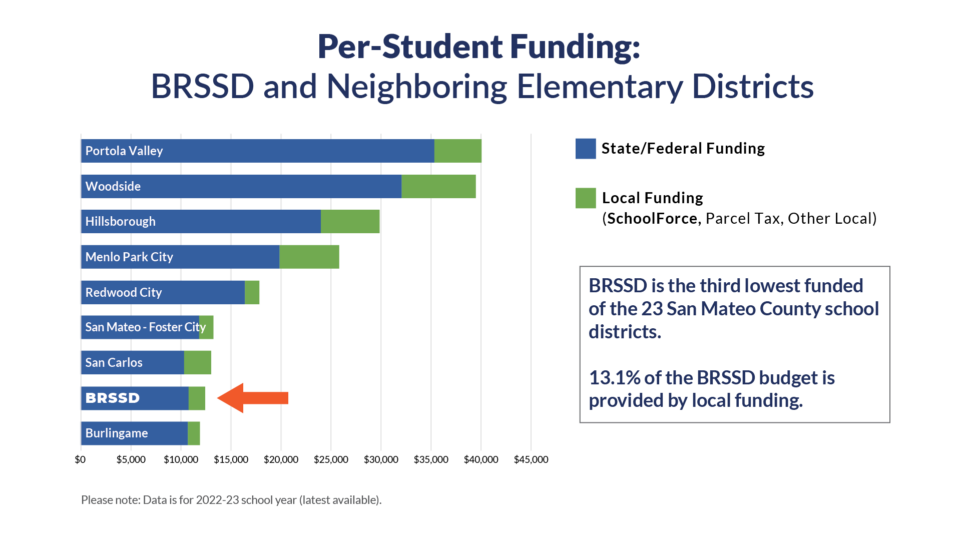

Proposition 13, passed in 1978, capped California property tax increases causing funding to public schools to dwindle. The result: California ranks 10th nationally in per-capita tax revenue, but 40th in per-student funding. The Belmont-Redwood Shores School District receives approximately $2,000 less per-student than the state average, and is the third lowest funded of the 24 districts in San Mateo County.

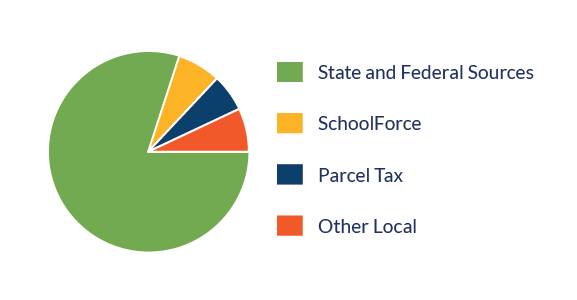

Because state funding only supports only the most basic education, we depend on donations to SchoolForce to fund additional staff and programs that ensure a well-rounded, robust learning environment for our kids. This includes science, libraries, school counselors & social emotional learning, music, art, P.E. & sports support, and help for kids who need academic intervention.

BRSSD FUNDING SOURCES

The state budget consists not only of property tax, but also of corporate taxes, income taxes and sales tax. Each year the state determines a baseline funding amount based upon its budget for educating a child. This formula severely under-funds public education in Belmont-Redwood Shores and thus, in order to keep high quality education in our community, additional funding is needed.

Watch this 2-minute video to learn more about why SchoolForce is needed.

For more information, visit SchoolForce.org/donate.